st louis county personal property tax waiver

A waiver or statement of non-assessment is obtained from the county or City of St. Search by Account Number or Address.

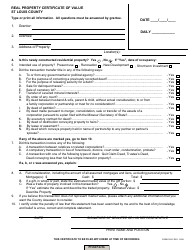

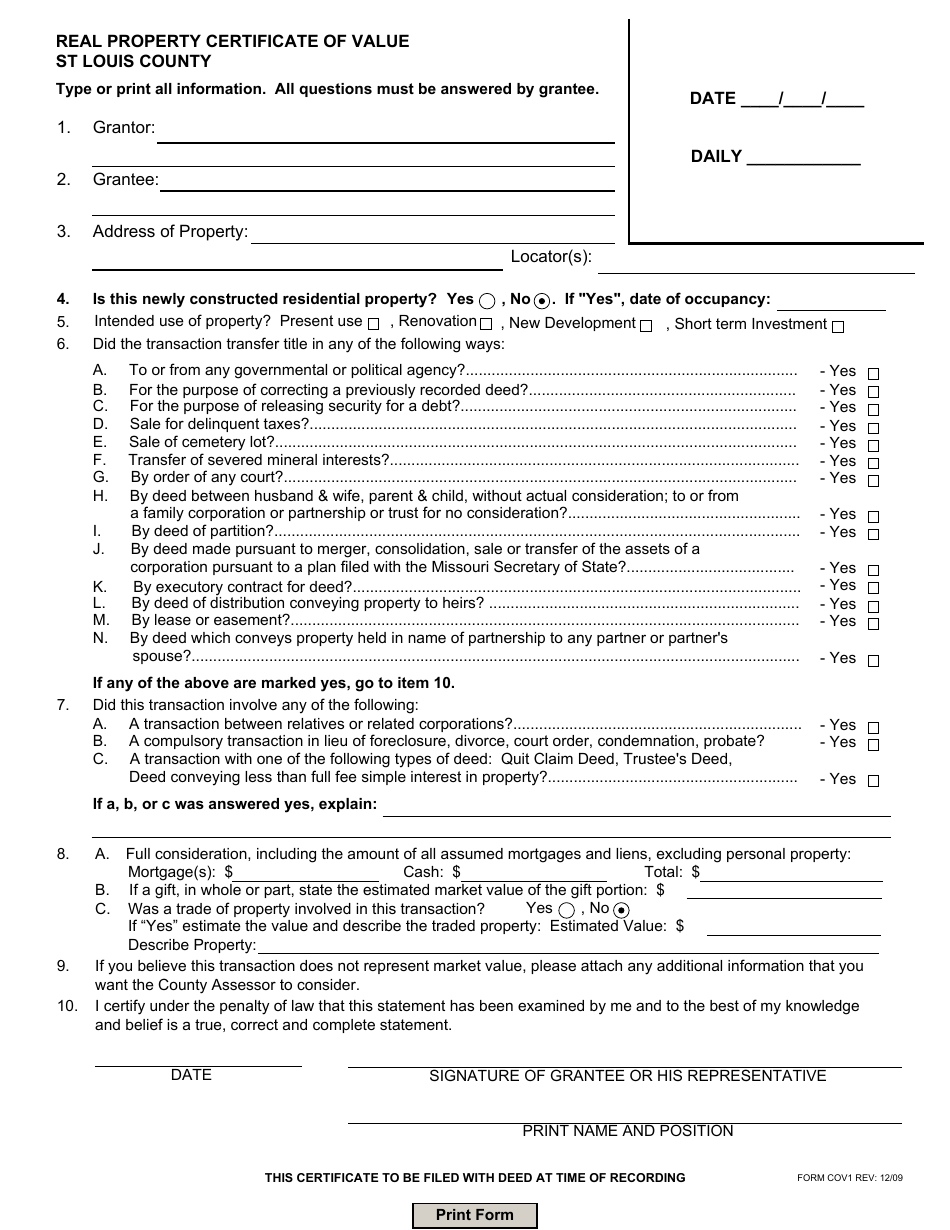

Form Cov1 Download Fillable Pdf Or Fill Online Real Property Certificate Of Value St Louis County Missouri Templateroller

Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now.

. Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st. IF TIME IS NOT AN ISSUE you can send an email to email protected with Waiver Request in the subject line and include the following. For years it has been rare for the Assessors Office to give out a Tax Waiver to anyone other than the individual.

Considering this where can I get a personal property tax waiver in St Louis County. The Personal Propety Taxes are due no later than December 31 of each year. Louis County Assessors Office in Clayton.

After all documentation has been received and processed the waiver will be mailed or emailed to you. The title signed over to you or an Application for Missouri Title in your name or out-of- state registration Business personal property issues can only be addressed at our Clayton location. Tax waivers for individuals and leased vehicles may be obtained at the St.

Leave this field blank. Please see FAQs for. Personal property tax waivers Personal property accountstax bill adjustment add or remove vehicle Pay taxes EXCEPT for delinquent real estate taxes 2017 and older.

Louis County Collector of Revenues Office in Clayton or at one of our three County Government. Since the COVID-19 outbreak it has taken the step of requesting this electronically via the assessors office. Central Ave Clayton MO 63105.

Scan the side of your ID or take a 360-degree photo. Louis MO 63129 Check cash money order Check cash money order M F. The full name of this company is e name.

Your address on January 1 for the past 3 years. Collector of Revenue 41 S. 8am 430pm Services Offered.

Your address on January 1 for the past 3 years. You will need to contact the assessor in the county of your residence to request the statement or non-assessment and to be added to the assessment roll for the subsequent tax year. What Do I Need To Get A Personal Property Tax Waiver In St Louis County.

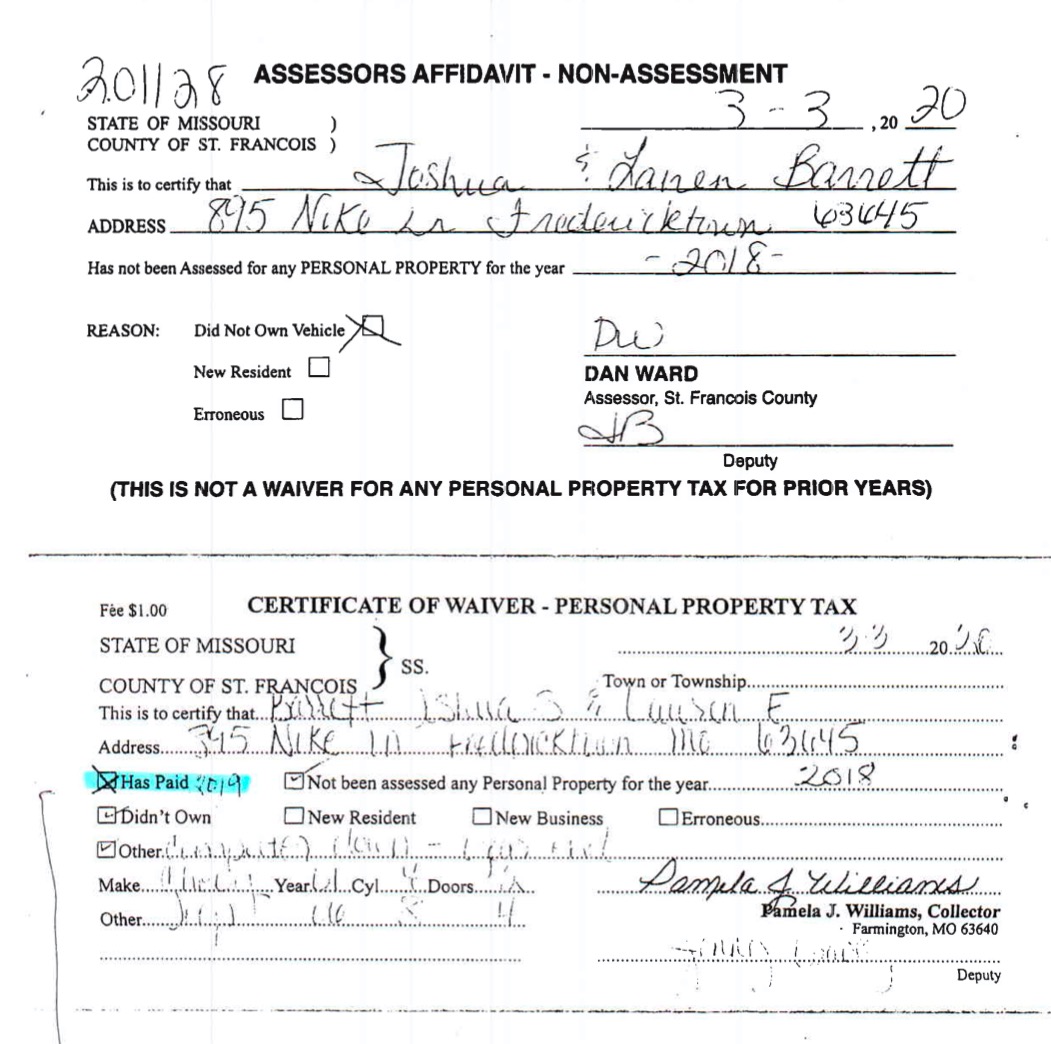

You moved to Missouri from out-of-state. Statement of Non-Assessment Tax Waiver If you are a new resident to the State of Missouri or did not own a motor vehicle on January 1st of the prior year you qualify for a tax waiver. Where Do I Get My Personal Property Tax Waiver In St Louis County.

The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. IF TIME IS NOT AN ISSUE you can send an email to email protected with Waiver Request in the subject line and include the following. Even if the property is not being used the property is in service when it is ready and available for its specific use.

Personal Property Tax Payment. From prior three years address for January 1 of this year is here. Residents with no personal property tax assessed in the prior year can obtain a statement of non-assessment tax-waiver Penalty for Late Filing - Personal Property Assessments Information on penalties for filing property assessments late Update Personal Property Name or Address Instructions to update your name or mailing address of record for Personal Property vehicle.

Your feedback was not sent. We are committed to treating every property owner fairly and to providing clear accurate and timely information. Collector of Revenue FAQs.

Your current year tax bill or obtain a duplicate tax bill from Collector of Revenue staff. Anfonwch e-bost at e-bost wedii warchod gyda Waiver Request yn y llinell bwnc. You are in an active bankruptcy Form 4491.

Please include your phone number in case of questions. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. This is your first vehicle.

We look forward to serving you. For assistance please call the phone number listed below. Tax waivers for businesses may be obtained only at the St.

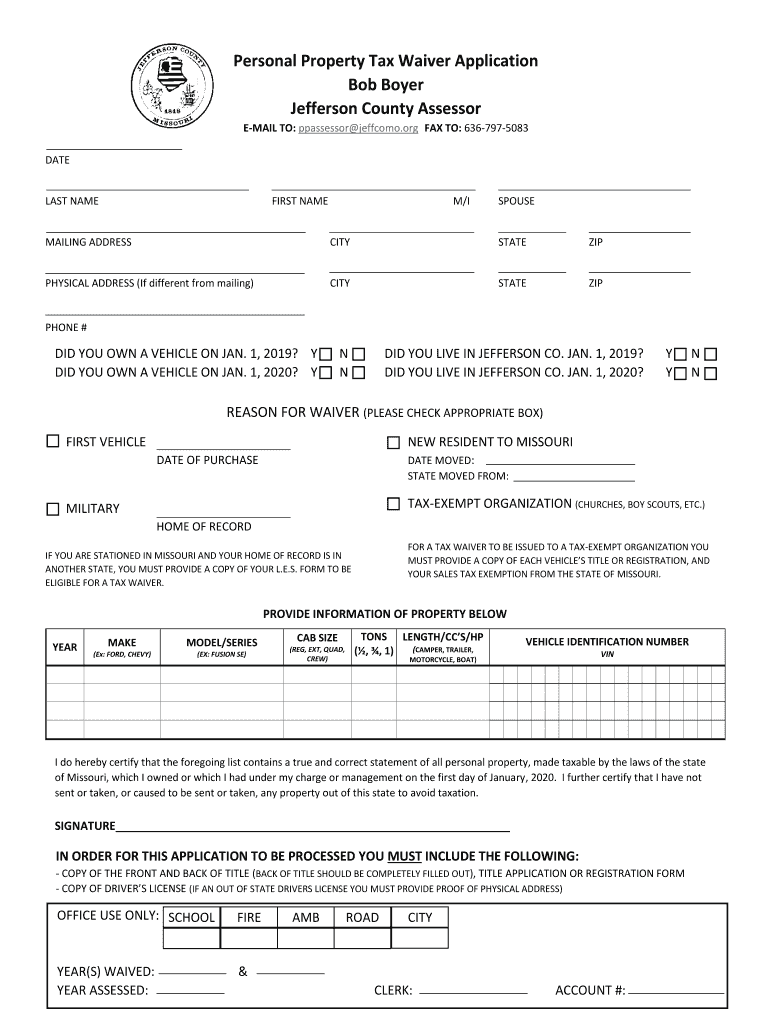

Jounal tit signed over to you or an Application for Missouri Title in your name or out-of-state registration. Provide the date you became a resident of St Louis County Waivers are issued only to new Missouri residents and those who did not own any personal property in previous years. Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity.

All Personal Property Tax payments are due by December 31st of each year. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous years. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year.

The address you have is the current one. To declare your personal property declare online by April 1st or download the printable forms. 8am 430pm M F.

The title signed over to you or an Application for Missouri Title in your name or out-of- state registration Business personal property issues can only be addressed at our Clayton location. Ad The Leading Online Publisher of National and State-specific Legal Documents. Louis County Assessors Office is responsible for accurately classifying and valuing all property in a uniform manner.

The title iliyosainiwa kwako au Maombi ya Kichwa cha Missouri kwa jina lako au out-of-state registration. USPS mail or Drop-Off in the Clayton Lobby. Louis assessor if you did not own or possess personal property as of January 1.

Review the steps to obtain a tax waiver.

St Louis County Board Approves Waiving Penalties For Late Property Tax Payments Fox21online

Form Cov1 Download Fillable Pdf Or Fill Online Real Property Certificate Of Value St Louis County Missouri Templateroller

Print Tax Receipts St Louis County Website

County Assessor St Louis County Website

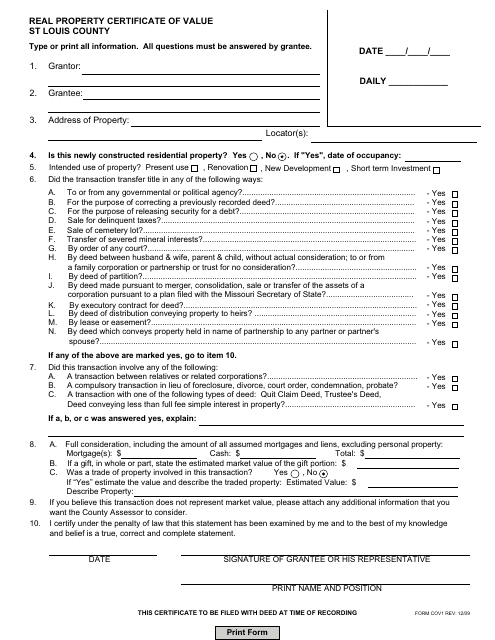

Title Deed Of Trust Date Please Return Deed To St Louis County

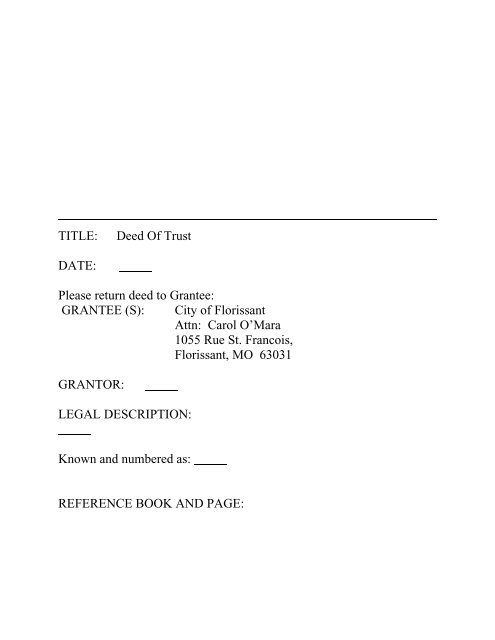

St Louis Subpoena Fill Out And Sign Printable Pdf Template Signnow

Waiting On Your Tax Bill St Louis County Says Printing Issue Delayed Mailing Vendor Says County Sent Files Late Politics Stltoday Com

Barrett S Problems Compounding In 3rd District Senate Race

Collector Of Revenue Faqs St Louis County Website

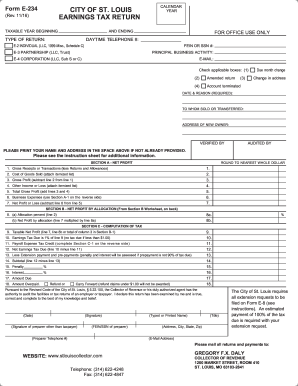

Get And Sign St Louis Mo City Earnings Tax Form 2016 2022

A Midas Touch Home St Louis Missouri

2019 Form Mo Personal Property Tax Waiver Application Jefferson County Fill Online Printable Fillable Blank Pdffiller

Collector Of Revenue St Louis County Website

A Midas Touch Home St Louis Missouri

Form Cov1 Download Fillable Pdf Or Fill Online Real Property Certificate Of Value St Louis County Missouri Templateroller

Saint Louis County Final Lien Waiver Form Missouri Deeds Com

County Assessor St Louis County Website

Saint Louis County Final Lien Waiver Form Missouri Deeds Com

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms